M-Kopa, a fintech company based in the UK, is embroiled in a tax evasion scandal involving Ksh 300 million.

UK-Headquartered Fintech Firm M-Kopa Caught in Ksh 300m Tax Evasion Scandal

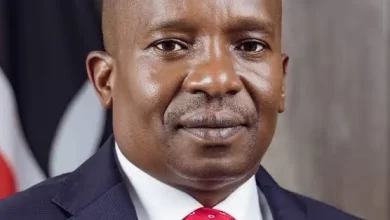

Solar energy provider M-Kopa finds itself in the middle of a turbulent period, with issues surrounding tax compliance and financial operations taking center stage at the company led by CEO Jesse Moore who is reportedly embroiled in a tax dispute with the Kenya Revenue Authority (KRA) as questions arise about its financial management practices.

A key element in this controversy revolves around an ongoing dispute regarding tax claims amounting to Ksh 308.5 million. M-Kopa attributes the financial burden to the failure of over 47,000 customers to repay for solar lighting kits acquired on credit but sources close to the matter have hinted that the number of customers listed as owing debts might have been exaggerated, with the actual number of debtors estimated at fewer than 20,000.

This discrepancy has raised suspicion about the true nature of the company’s debt claims, particularly as it seeks relief from the Tax Appeals Tribunal. M-Kopa appears to be using this debt situation as a defense to explain its current financial predicament. The firm has presented its case to the Tax Appeals Tribunal seeking to have the large debt written off.

They claim that their attempts to recover the money from these clients have proved costly. According to the company, it would require Ksh 952.5 million to pursue the defaulters, with each recovery effort estimated at Ksh 20,000. Should the matter go to court, M-Kopa estimates that it would cost them even more, totaling up billions in legal fees with each case running about Ksh 109,640.

Alternatively, an out-of-court settlement was calculated to cost Sh1.77 billion, according to their submissions. These figures have not been well received by KRA, which insists that M-Kopa has not demonstrated enough effort to recover the debts, leading to the dispute over the tax liabilities.

Fintech Firm M-Kopa

Fintech Firm M-Kopa

In 2016, KRA had initially demanded KSh 308,512,947 from the company. This was later revised to KSh 193,736,915. While the tribunal ruled in favor of M-Kopa, stating that the recovery costs would outweigh the debt, there remain doubts within the industry.

Observers believe M-Kopa is still pursuing some of these customers and that if they succeed, KRA may miss out on collecting any further taxes. The authority believes that M-Kopa’s approach is part of a wider effort to avoid paying taxes.

Further complicating the situation is the suspicion that M-Kopa has added customers who purchased electric bikes on credit to this debtor list. This tactic has reportedly been employed as part of a broader strategy to avoid fulfilling tax obligations.

The tax dispute has placed the company under increasing pressure, with industry insiders questioning the legitimacy of its claims and the extent of its operations in the country.

The solar firm, which has been active in Kenya since 2022, caters to millions of clients, offering products such as televisions and smartphones on a pay-as-you-go basis.

It has also attracted international attention, having secured a loan worth Ksh 1.9 billion from General Investments Management, a fund associated with former U.S. vice-president Al Gore. Despite these business ventures, M-Kopa has faced legal hurdles in the past. A lawsuit filed by a local businessman named Patrick Kamau accused the company and a local telecommunications giant of infringing on his rights.

Fintech Firm M-Kopa

Fintech Firm M-Kopa

As attention mounts on M-Kopa’s tax compliance, the KRA is contemplating escalating the matter to the High Court. The firm had previously appealed against a hefty tax demand from the KRA for the financial years between 2017 and 2019, amounting to approximately $6.8 million.

M-Kopa had argued that as an entity incorporated in the United Kingdom, it should be exempt from Kenyan taxes under the Kenya-UK Double Taxation Treaty. Nevertheless, the tribunal concluded that the firm’s core management decisions are made within Kenya, discrediting the company’s claim that it should not be taxed locally.

The ruling has not only put M-Kopa on notice but has also drawn attention to its activities across Africa, where it operates in other countries such as Nigeria, Ghana, and South Africa. As the situation unfolds, all eyes will be on the KRA’s next steps and whether M-Kopa will be compelled to clear its outstanding tax obligations or find itself embroiled in further legal battles.